Do you know all of your tax requirements as a small business owner? Do you know how to prepare the correct forms or know what you can or can’t deduct?

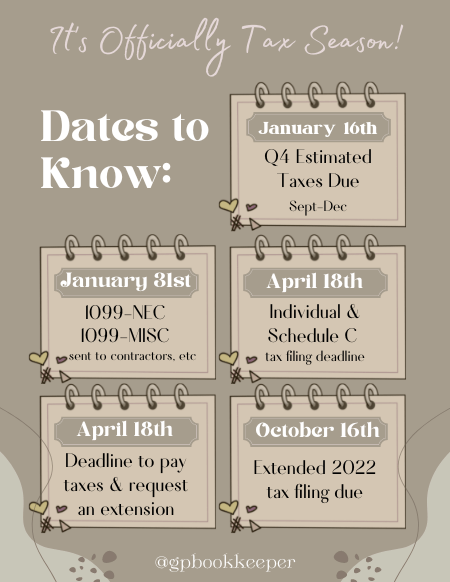

Here are a few important deadlines that you should know & understand:

- January 16, 2023: Q4 Estimated Taxes Due (for profit in Sept-Dec 2022)

- January 31, 2023: 1099-NEC & 1099-MISC Forms sent to contractors, for rents paid, etc.

- April 18, 2023: Individual Tax Deadline (for all Schedule C sole proprietor filers)

- April 18, 2023: Deadline to pay taxes & request an extension

- October 16, 2023: Extended 2022 Tax Filing Deadline

Does your head spin reading through the graphic & bullet points above?!

That’s where I come in! Reach out if you want help understanding any of what’s above! I’d be happy to help guide you through tax season for your business 👩🏻💼

Think you’re in need of a bookkeeper to help you record your transactions, organize your operations, and provide insight on your expenses? Feel free to reach out! Although I am located in Brockport, NY, I serve clients from Florida to California 🙂 Let me know how I can help you!